New Settlement Procedure for Unintended Exchange in Continental Europe

Authors

K. KLEINEKORTE - RWTH Aachen University

U. KASPER, S. OLIVARES NOGUERA, F. REYER, M. STOBRAWE - Amprion GmbH

Summary

Interconnected power systems are the platform to enable cross-border energy exchanges. The remainder of this article describes the new settlement procedure for unintended exchange in the synchronous area of Continental Europe set into force June 2021. The change in system accounting is motivated by the advanced liberalization of the European power sector as well as a set of European regulations established in recent years. After briefly describing major physical and regulatory aspects as well as the principles of system planning and accounting, the different components of intended and unintended exchanges in interconnected power systems are deduced.

Based on the already existing structures for coordination and system-wide accounting of exchanges in Continental Europe, the implementation of the new settlement procedure for unintended exchanges is illustrated in detail. This highlights that fostering competition in liberalized power systems comes along with additional complexity which has to be dealt with in system operation.

First operational experiences are highlighted before summarizing the key findings and giving an outlook on how to develop further.

Keywords

Liberalized power system, load frequency control, financial settlement, intended exchange, unintended exchange, transmission system operator1. Introduction

When operating an AC-based power system, frequency is the most important characteristic value because it allows to assess the power balance at any time. For systems in island mode, simply frequency control facilitates keeping the balance between load and generation, given that all power flows are internal. However, interconnected power systems usually consist of several load frequency control areas (LFC areas), which are demarcated by points of measurement at tie-lines to other LFC areas and are operated by one or more transmission system operators (TSO) fulfilling the obligations of load frequency control [1]-[4]. This enables intended energy exchanges between LFC areas. According to (1), the well-known area control error (ACE) allows to consider not only frequency deviations Δf but also deviations of scheduled flows ΔP between LFC areas, when balancing each LFC area.

(1)

Until the European Guideline on Electricity Balancing (GL EB) asked to change the compensation methodology, unintended exchanges were compensated amongst the interconnected partners physically, i. e. via compensation programs “in kind”. This methodology was established since the interconnected operation started in 1958.

The increasing complexity of cross-border processes for energy trading motivates the transition to financial compensation of the unintended exchange. Today, energy trading is generally based on quarter-hourly time intervals. Correspondingly, financial compensation of unintended exchange in Continental Europe is also conducted on quarter-hourly basis.

GL EB aims at creating a European cross-border market for balancing energy [5]. It focusses not only on balancing energy cooperations for Replacement Reserve (RR), tertiary reserve (manual Frequency Restauration Reserve, mFRR), secondary control reserve (automatic Frequency Restauration Reserve, aFRR) and Imbalance Netting (IN) causing intended exchange between the participating TSOs, but also on unintended exchange. Article 50(3) of GL EB is the basis for the implementation of financial settlement of intended exchanges of primary control reserve (Frequency Containment Reserve, FCR) and ramping requirements within a synchronous area. Both elements have been implicitly compensated as a share of the unintended exchange in a synchronous area with the previous compensation mechanism.

Additionally, Article 51(1) of GL EB is the basis for the implementation of financial settlement of unintended exchanges. According to GL EB, balancing energy prices are to be considered for pricing of unintended exchanges. Furthermore, Article 6(5) of Regulation on the internal energy market for electricity (recast) as part of the “Clean Energy Package” requires imbalances to be settled at the real-time value of the energy [6].

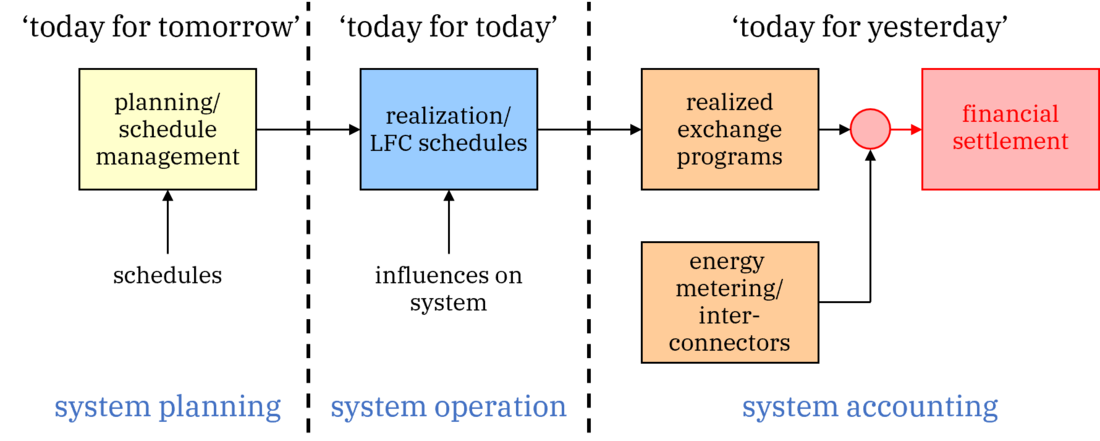

This article describes the methodology for financial compensation of unintended exchange in Continental Europe as well as practical experiences in implementation and operation. Figure 1 shows the relevant process steps.

Figure 1 - Changes in system planning and system accounting

2. Intended and Unintended Exchanges in Interconnected Power Systems

Basically, energy transactions, which can irrespective of their time duration (long-term, mid-term or short-term) also be described as intentional energy exchanges, are characterized by the following features [7]:

- Energy deliveries must be agreed in advance; if necessary, this agreement can be made until shortly before the start of the delivery period.

- For settlement purposes, it is assumed that within a market time unit (without ramping), the delivery always takes place with constant output.

- The sequence of several market time units is called a schedule (power-time profile).

- The supplier is responsible for delivering the agreed amount of energy to the interconnected grid according to the agreed schedule.

- Generally, energy transactions are agreed bilaterally.

- The ordered energy is paid for according to the schedule.

Since electricity flows are based on Kirchhoff's circuit laws, in interconnected operation a bilateral delivery (a purchase) is physically not possible. Rather, the energy is delivered to the interconnected grid by the supplier, and the recipient draws the agreed amount of energy from the interconnected grid. For this purpose, the partners set a corresponding export (import) on their load frequency controllers without taking the counterpart into account.

It is part of the nature of electrical energy that it cannot be stored to any significant extent (yet). Instead, the instantaneously generated energy must always be adjusted to the instantaneously consumed energy. The quality criterion for maintaining this equilibrium is the system frequency. According to (1), the load frequency control of each LFC area controls just in a way that the ACE, i. e. the linear combination , is zero[1]. A frequency deviation of the interconnected system therefore results in a deviation of all actual exchanged powers from the planned setpoint to counteract the imbalance of the overall power balance. This mutual support is explicitly intended and represents one of the major advantages of interconnected operation. However, due to the superposition of many individual influences, such as a power plant failure, changes in load, manual dispatching, start-up ramps and limited actuating speed of the control units, the desired state of equilibrium at nominal frequency can only be achieved with finite accuracy.

The planned energy exchange between partners in an interconnected system therefore cannot be realized exactly. The deviation between the actual and the planned energy exchange is referred to as “unintended exchange”. It has already been mentioned that energy deliveries or purchases always take place “to the grid” or “from the grid”. For this reason, the unintended exchange of a partner in the interconnected system always results in a debt or credit “to the grid”, i. e. the community of all partners in the interconnected system.

According to (2), the exchange of electrical energy Eex of an LFC area consists of the intended exchange Eie and the unintended exchange Eue.

(2)

Until the liberalization of the electricity market in Europe, the intended exchange energy Eie consisted of two components, namely the agreed exchange schedules Esch and the exchanges based on virtual tie lines EVTL. Equation (3) illustrates this relation. A virtual tie-line (VTL) has been used to virtually assign a generation unit to a different LFC area, in which the power plant has not been connected physically. This was done by taking into account the generation units feed-in when calculating the contour integral: The receiving LFC area added and the providing LFC area subtracted the generation unit’s measured value.

(3)

GL EB defines additional components of the intended energy exchange Eie such as

- the energy exchanged for manual Frequency Restoration Reserve (mFRR) EmFRR,

- the energy exchanged for automatic Frequency Restoration Reserve (aFRR) EaFRR,

- the energy exchanged for Imbalance Netting (IN) EIN,

- the energy exchanged for Frequency Containment Reserve (FCR) EFCR,

- the energy resulting from the ramping periods (RP) of cross-border exchange schedules ERP as well as

- the energy ERR resulting from exchanges for Replacement Reserve (RR) performed via standard cross-border exchange schedules.

Today, energy balancing products are cross-border products and no longer dealt with solely internally within the LFC areas. From a technical point of view, energy exchanges for aFRR and mFRR balancing cooperations and IN are realized via virtual tie lines (VTL), i. e. they are a special representation of the previously described VTL mechanism. In fact, IN is just a specialized type of aFRR activation, i. e. avoiding the counter activation of FRR in different LFC areas, if sufficient cross-zonal capacity is available to accommodate the resulting power flows. While virtual interconnections have been abolished for power plant operators during unbundling and liberalization of the electricity market in Europe, they continue to be used in balancing cooperations amongst TSOs. As such cooperations are fostered and formalized by GL EB as so-called balancing platforms, the amount of VTLs used in system operation will even increase in the upcoming years. Energy exchanges for Replacement Reserve (RR) ERR are considered in the exchange schedules, i. e. they are a special component of agreed exchange schedules Esch.

Considering all the aforementioned, (2) can be extended to (4).

(4)

Now with GL EB in place, a more detailed distinction between the intended and unintended shares of unintended deviations had to be introduced. An LFC area’s share in FCR EFCR and ramping energy ERP is an intended deviation from planned exchange via schedules Esch or VTLs EVTL and therefore contributes to the overall amount of intended exchange Eie. However, further deviations from the physical flows Eex remain unintended exchange Eue.

According to (5), the contribution to FCR depends on the frequency deviation between the nominal frequency and the actual frequency in the synchronous area as well as the share K of the LFC area in the joint FCR process [3]. For unintended exchange, the frequency deviation

as quarter-hourly average is used because the quarter-hour corresponds to the settlement period

.

(5)

The following sections describe the different elements of intended exchange in detail.

2.1. Intended Exchange Components

2.1.1. Exchange Schedules

The exchange schedule of an LFC area represents the sum of all nominated external (cross-border) schedules. It is a time series in quarter-hourly resolution[2]. The control program of an LFC area is based on this schedule, i. e. the load frequency controller ensures compliance with this (target) exchange by activating balancing services.

According to (6), the scheduled exchanges Esch consist of bilateral exchanges over the counter (OTC) EOTC, exchanges via power exchanges (PX) EPX and the already introduced scheduled-based exchange of Replacement Reserve (RR) ERR.

(6)

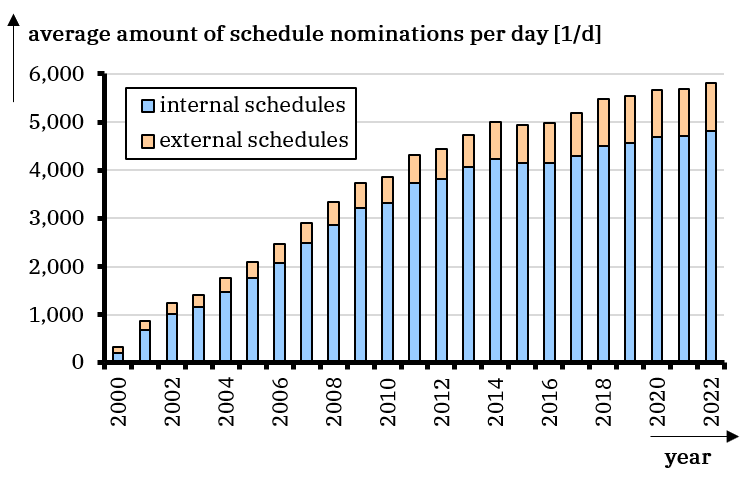

In a liberalized market, power exchanges act as central trading partners (aggregators). The accompanying standardization and anonymization have led to a strong reduction of the previous bilateral (over the counter) electricity trading and a significant increase in internal and external schedule nominations (figure 2), as electrical energy is now traded several times before physical delivery.

Figure 2 - Average amount of schedule nominations per day in the LFC area Amprion/Creos

2.1.2. Frequency Containment Reserve

Short-term imbalances in the synchronous area of Continental Europe are initially compensated by Frequency Containment Reserve (FCR) in accordance with the solidarity principle, irrespective of the imbalanced TSO. According to Guideline System Operation (GL SO) Art. 153(2)(b)(i), ±3,000 MW FCR are procured in Continental Europe and distributed proportionally to the individual LFC areas depending on load and feed-in quantities (GL SO Art. 153(2)(d)) [1]. This is represented by the K‑factor of (5) for each LFC area, which is distributed amongst the service providing units.

In 2012, Germany started an initiative to procure FCR no longer solely internally but cross-border as well. Until 2023, APG (Austria), CEPS (Czech Republic), ELES (Slovenia), Elia (Belgium), energinet (Denmark), RTE (France), Swissgrid (Switzerland) and TenneT NL (Netherlands), joined this FCR cooperation [8]. Consequently, the FCR provision (and thus the K-factor) changes depending on the tender results with respect to each product interval, i. e. currently every four hours.

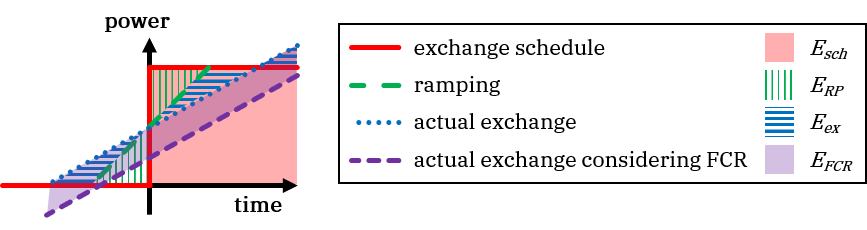

According to figure 3, the energy exchanges resulting from FCR activation cause a parallel shift of the exchange schedule for a constant frequency deviation and must be considered when determining the unintended exchange.

Figure 3 - Illustration of interdependencies between intended and unintended exchanges of an LFC area in case of ∆f>0

As FCR is provided in a decentralized manner and from frequently changing providers, it is difficult to measure actual values. Therefore, the frequency setpoints are used for calculating this intended share of energy exchange. According to (7), the component of FCR provision of an LFC area i depends on the difference between the frequency setpoint and the actual frequency in the synchronous area as well as the K-factor. For settlement purposes, the mean value of a quarter hour

is applied as

.

(7)

The frequency deviation is defined as the quarter-hourly average frequency deviation in a reference node of the synchronous area Continental Europe. This value is used to determine EFCR in the entire interconnected system.

2.1.3. Virtual Tie-Lines and their use for the exchange of automatic and manual Frequency Restoration Reserve and Imbalance Netting

As Frequency Containment Reserve is activated via proportional control, FCR limits a frequency deviation and thus stabilizes system frequency/balance at a different level than the frequency setpoint. In contrast, aFRR and mFRR are governed by integral control, they restore the intended exchange of an LFC area and the target frequency. In principle, both Frequency Restoration Reserves (FRRs) are initially activated in solidarity by all LFC areas. As much as FRR is activated in the LFC area causing the deviation the solidary help of all others is reduced accordingly. As power balance is restored locally, system frequency returns to its target value.

In March 2010, German TSOs started the Grid Control Cooperation (GCC) for the German LFC block [9]. They jointly dimension, procure and activate aFRR and mFRR. For FRR, virtual tie-lines are used to activate the most competitive bids across all LFC areas. Using virtual tie-lines, the demand of one LFC area is transferred to the LFC area with the cheapest bid, allowing the local activation.

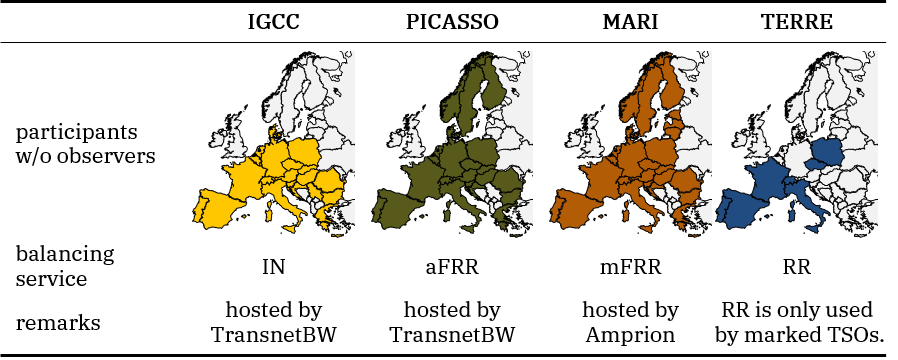

In comparison to GCC, the International Grid Control Cooperation (IGCC) represents a simplified cooperation using virtual tie-lines, to avoid counter activation of aFRR. However, this requires availability of sufficient cross-zonal transmission capacity. Based on GL EB, IGCC has been recognized as European imbalance netting platform. Therefore, almost all Continental European TSOs have joined by 2023 [10].

Since July 2016, aFRR energy is exchanged between Austria and Germany. Since September 2019, this cooperation has been extended to the exchange of mFRR as well. In parallel to these bilateral activities, GL EB has created the framework for balancing platforms allowing the cost-optimized activation of FRR. The Platform for the International Coordination of Automated Frequency Restoration and Stable System Operation (PICASSO) went into operation on June 1st, 2022, the Manually Activated Reserves Initiative (MARI) followed on September 1st, 2022. The European TSOs are joining these platforms successively.

Figure 4 illustrates the geographical scope of the four European balancing Platforms IGCC, PICASSO, MARI and Trans European Replacement Reserves Exchange (TERRE).

Figure 4 - Geographical scopes of European balancing platforms

MARI, PICASSO and IGCC require secure and highly reliable data exchange channels to enable VTLs as the activated exchanges must be considered in the control programs of the participating LFC areas in real-time. With the increasing number of cooperations since 2010, the amount and impact of VTLs has increased significantly. It is common practice to aggregate the exchange values to quarter-hourly averages when determining the (un-) intended exchange.

2.1.4. Ramping

There is the possibility to reduce unforeseen short-term deviations between feed-in and withdrawal of electrical energy by introducing ramps for schedule changes. For cross-border exchanges of scheduled energy in Continental Europe, 10-minute-ramps (ramp starts 5 minutes before the schedule change and ramp ends 5 minutes after the schedule change) have been established. Deviations in the exchange of electrical energy resulting from the ramping requirements must be considered when calculating the unintended exchange.

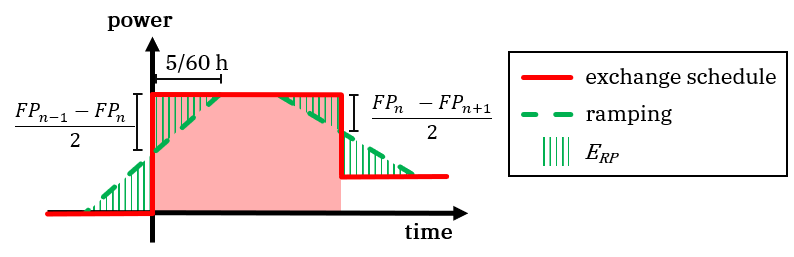

The ramping energy of each quarter hour corresponds to the difference between the exchange program schedules assumed as a step change and the values ramped over 10 minutes, as shown in figure 5.

Figure 5 - Ramping energy

Ramping of the schedules over 10 minutes is applied in the entire synchronous area [11]. Since all TSOs of Continental Europe apply these ramps in a harmonized way, this component is classified as intended exchange of energy.

The ramping energy of LFC area i in quarter hour n depends on the exchange schedules with external LFC area j in the adjacent quarter hours

,

and

(8).

(8)

3. System Coordination and Accounting in Continental Europe until May 2021

After the different components of intended exchange have been introduced in the previous section, this chapter describes how the exchange of electrical energy in Continental Europe has been coordinated and accounted until May 2021. The underlying concept with two Coordination Centers (CCs) is introduced as well. This provides the basis for the financial settlement of unintended exchanges in Continental Europe as introduced in June 2021.

Considering the entire synchronous area of Continental Europe, there has to be a corresponding import schedule for every export schedule at any point in time. Thus, there is no surplus in generation or consumption, which would have to be balanced by the interconnected partners by activating balancing energy. The sum of all schedules must always sum up to zero. This coordination process is called system planning/schedule management and conducted “today for tomorrow”. In Continental Europe, two CCs are responsible for its duly conduction.

The second task of CCs is energy accounting, which is conducted “today for yesterday”. It also comprises the determination of the unintended exchange. The methodological approach is described in several publications [7], [12].

Up to and including May 2021, the inter-TSO settlement of unintended deviations corresponded to the physical compensation of unintended exchange. A compensation in kind aimed at a return-delivery of the unintentionally exchanged energy without any systematic advantage or disadvantage for a TSO. On the long run the unintended exchange of each LFC area is an ideally zero-mean random variable. The unintended exchange has been accumulated during a “recording period” of one week and was compensated in a “compensation period” of also one week. Compensation has been structured as a band delivery of constant power. As electrical energy is priced differently at different times, the weekly period with averaging has served to equalize the compensation and thus avoid systematic advantages/disadvantages.

The determined compensation program has been implemented via exchange schedules as part of the intended exchange.

3.1. Coordination Center

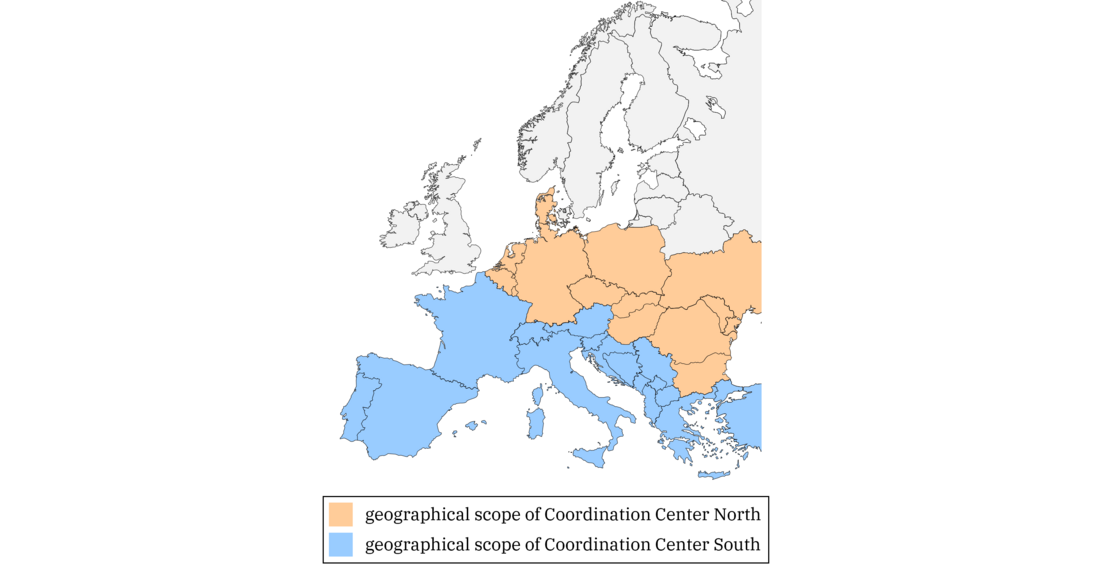

Theoretically, each TSO could coordinate with the operators of its neighboring LFC areas individually during system planning. However, it could not be checked in this case whether all intended energy exchanges in the synchronous area sum up to zero. To avoid errors and improve coordination, it has proven useful to have two CCs in place. Swissgrid and Amprion coordinate this process for the southern and northern parts of the synchronous area. Figure 6 shows the respective areas of responsibility. Since the ad-hoc synchronization of Ukraine and Moldova with the Continental European transmission system on March 16th, 2022, the CC North/Amprion supports the coordination with the TSOs of these countries.

Figure 6 - Geographical scopes of CCs North and South in Continental Europe

Inter-TSO settlement is structured hierarchically. The fundamental level is a “settlement zone”, which corresponds to the LFC area of a TSO. Several settlement zones can correspond to one “settlement block”. It is identical to the respective LFC block. An overview on the individual zones and blocks in Continental Europe as agreed amongst TSOs is publicly available [13].

4. Financial Settlement of Unintended Exchange in Continental Europe since June 2021

GL EB Articles 50(3) and 51(1) require all TSOs of a synchronous area to jointly develop methodologies for the financial settlement of EFCR, ERP and Eue, which is subsequently to be approved jointly by the concerned National regulatory authorities [14], [15]. In these methodologies the main characteristics of the financial settlement are defined as follows:

- A settlement period of a quarter hour is defined.

- Uniform pricing for EFCR and Eue is determined as a weighted average of day-ahead market prices across the synchronous area, with an additional frequency-dependent component. This price is valid for the entire synchronous area.

- A pricing of 0 €/MWh is defined for ERP.

In this chapter, the established principles of financial settlement are further evaluated.

4.1. Settlement Period

The settlement prices of unintended exchange should reflect the real-time value of the energy [5], [6]. For cross-border processes, the quarter hour has been established as the shortest product period. It is also established as imbalance settlement period in entire Continental Europe (GL EB Art. 53(1)) as well as validity period of standard products for balancing energy in entire Europe. Therefore, it makes sense to also use the quarter hour as the settlement period for financial compensation. Both the recording of quantities and the determination of a settlement price thus take place on quarter-hourly basis. This establishes a direct connection between settlement periods and the unintended exchanges that occurred at that time interval. In the process for compensation of unintended exchange, process granularity has moved from a daily/weekly basis to a quarter-hourly basis, ensuring consistency with the cross-border scheduled energy exchanges. Consequently, LFC areas with a high amount of unintended exchanges can be directly identified on a quarter hourly granularity.

4.2. Accounting of Unintended Exchange

Finally, according to (9), the actual unintended exchange results from the deviations between actual exchanges Eex and all components of the intended exchange energy Eie. These include both planned scheduled energy exchanges Esch, exchanges via virtual tie-lines EVTL as well as the two components EFCR and ERP already introduced in (4).

(9)

In contrast to the former compensation programs, additional input data is required for the determination and recording of unintended exchange. The metered physical exchanges Eex and the schedule exchange programs Esch have already been the basis for compensation in kind. For the determination of EFCR, the average frequency deviation per quarter hour and the individual K-factor for each LFC area are required. For the determination of ERP, no further input data is necessary as it can be calculated from Esch.

An important principle in the settlement of unintended exchange is the zero sum of energy quantities. According to (10), this rule also applies for ramping energy since the underlying schedules also have a zero sum. However, since FCR is provided by all TSOs at one point in time in the same direction and thus cannot have a zero sum, the sum of all unintended exchanges Eue is not zero. But based on (11), the sum EFCR+Eue of all LFC blocks i in the synchronous area is zero.

(10)

(11)

GL EB specifies in article 50(3) a financial compensation for the intended components EFCP and ERP and article 51(1) specifies a financial compensation for the unintended component Eue within a synchronous area [5]. The determination of the compensation for electrical energy EVTL exchanged within the framework of balancing platforms via virtual tie-lines results from the specifications in GL EB Article 50(1) [5]. (10) and (11) describe the zero sum of the energy quantities, which translates into a zero sum of the corresponding financial flows, if the same price is applied for EFCR and Eue. This ensures that neither total costs nor total revenues are generated by the financial compensation, but only a redistribution between TSOs due to the unintended exchanges takes place. In Continental Europe, ramping energy, energy for Frequency Containment Reserve and unintended exchange are each compensated with an individual but uniform price.

It is common practice to charge the components EFCR and ERP separately.

4.3. Pricing for Ramping Energy

The volume of ramping energy sums up to zero over longer periods in time [15]. Furthermore, ramping energy is not related to system imbalances, so no financial incentive is required or would be appropriate to reduce these volumes. Due to these circumstances, a pricing of 0 €/MWh is applied for ramping energy.

4.4. Pricing for Unintended Exchange and Activated Frequency Containment Reserve

A uniform price in the synchronous area is determined for the components EFCR and Eue. It is envisaged that this price reflects the real-time value of electrical energy based on balancing energy prices [5], [11]. However, when introducing financial compensation in June 2021, the relevant European balancing platforms were not yet fully implemented. After go-live of these platforms and after accession of all TSOs in Continental Europe, a harmonized balancing energy price will be available. Until then, balancing energy prices are based on different national market mechanisms and do not yet form a consistent system-wide price indication for electrical energy in real-time.

Therefore, day-ahead prices for scheduled energy are used as an interim solution. Due to the progress of projects for cross-border market coupling, a degree of harmonization has been achieved at this market which makes the price for scheduled energy a good estimator of the short-term value of electrical energy in each country. Power-exchange-based day-ahead prices are available for each scheduling area. Unintended exchanges as well as the provision of FCR result from imbalances per LFC area and thus influence system frequency. To form a uniform price from the day-ahead market prices DAMP across Continental Europe, a weighting is applied based on the components EFCR and Eue. According to (12), Pref,n is used as the reference price for the compensation of unintended exchange for quarter hour n and every LFC block i.

(12)

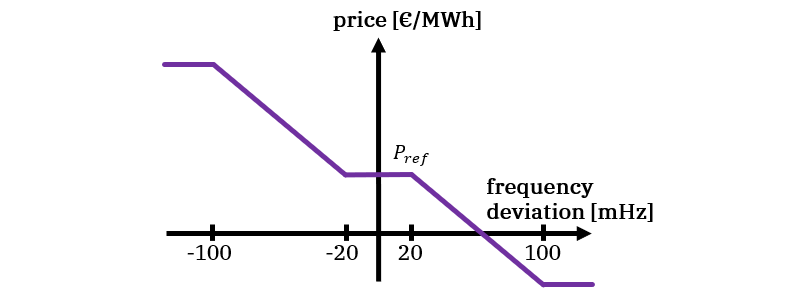

It is critical, if these imbalances or unintended exchanges occur in a direction increasing the frequency deviation. To provide a financial incentive counteracting this behavior, a frequency-dependent component is applied to the reference price. As shown in figure 7, this component forms a premium/discount to the reference price.

Figure 7- Frequency-dependent component

The frequency-dependent component was designed in a way that it is not applied in the case of small frequency deviations, thus avoiding price peaks in relatively unremarkable settlement periods. In addition, the frequency-dependent component is limited to a frequency deviation of 100 mHz. The aim is also to avoid inappropriate price peaks.

According to (13), the settlement price PFCR+ue for the quarter hour n is used to determine the financial compensation for each LFC area in the Continental European synchronous area.

(13)

5. Exemplary Settlement

On June 1st, 2021, financial compensation of unintended exchange has been gone live. As of this date, the three components EFCR, ERP and Eue are financially compensated in the Continental European synchronous area. This section reports on the initial operational experience.

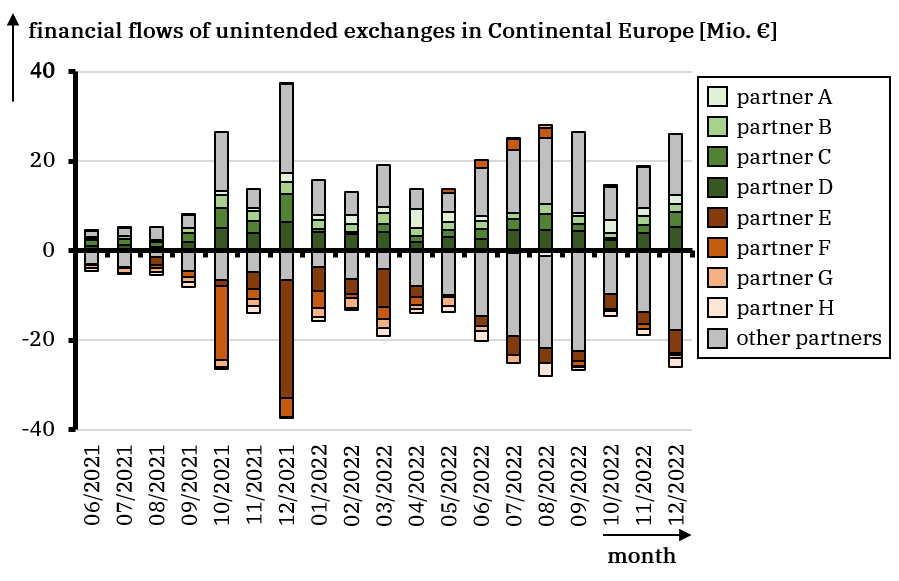

Introducing financial settlement of unintended exchange has increased TSOs’ awareness of the process. Situations with a high settlement price or with high unintended exchange volumes attract attention due to the resulting high financial flows. For the first time, they can be intuitively assigned to specific LFC areas. In the first months of operation, a price increase has been observed which reflects the general price development at the energy markets. Figure 8 illustrates the history of financial compensation in the first months of operation.

Figure 8 - History of financial flows due to unintended exchanged during the first months of operation

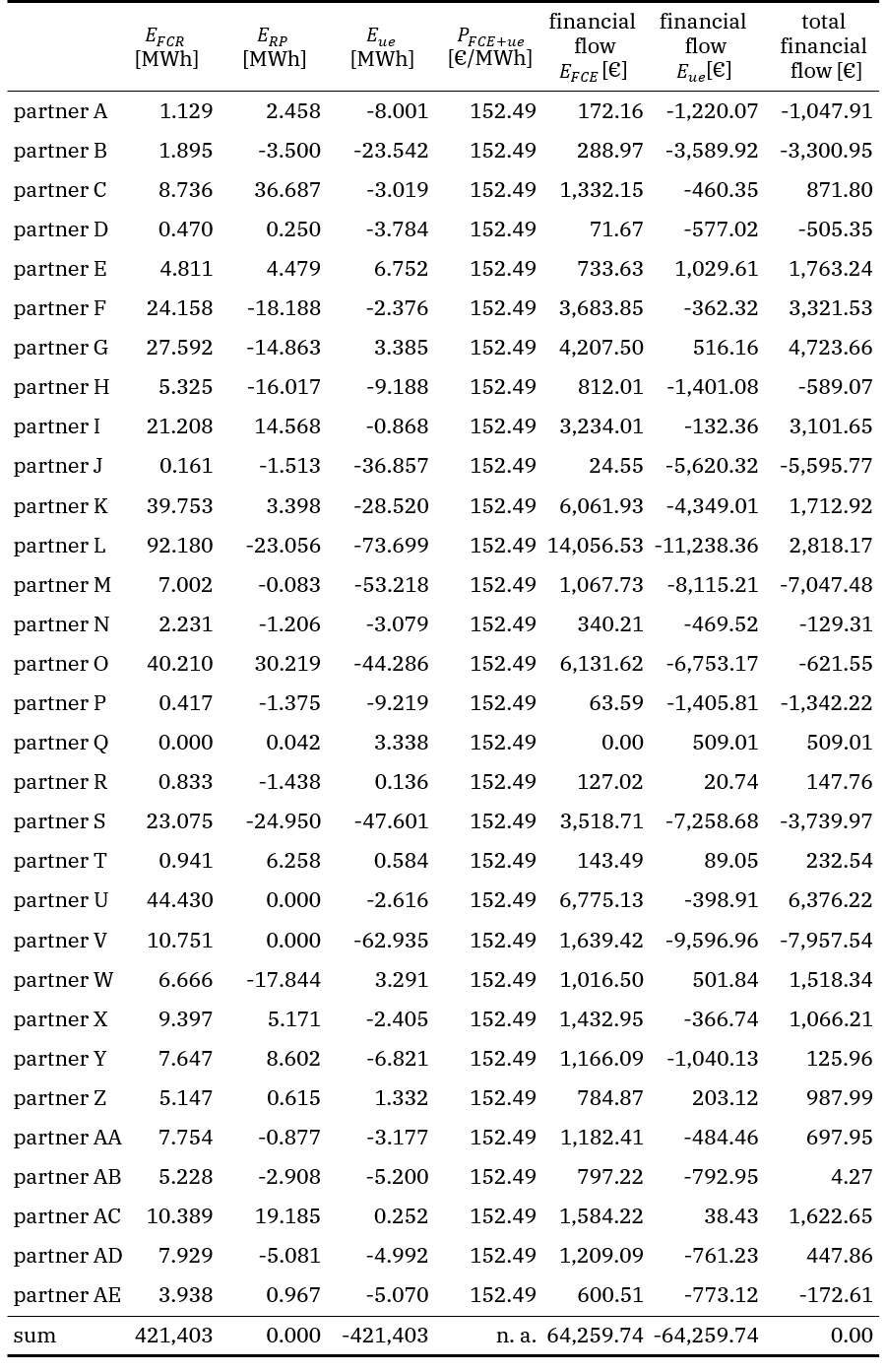

Table 1 provides detailed but anonymized information on the settlement of an exemplary date and market time unit, i. e. August 1st, 2023 from 00:00 to 00:15 CEST. The table lists the energy EFCR provided by the FCR process, ramping energy ERP as well as the identified unintended exchanges Eue per TSO in the synchronous area. In the table, a positive sign indicates export of energy from the TSO towards the synchronous area while a negative sign indicates import of energy from the synchronous area to the TSO. The sum in the last row of the table demonstrates that the sum of ramping energy ERP as well as the sum of EFCR+Eue over all TSOs equal to zero (section 4.2). The principle of uniform pricing for the entire synchronous area (section 4.4) results in the same PFCR+ue being applied for settlement of EFCR and Eue to all TSOs. (According to section 4.3, ERP is priced with 0 €/MWh.) The resulting financial flows to settle the energy amounts EFCR and Eue are provided in the last but two and last but one column of the table. The last column sums up these values and provides the resulting total financial flow. In this context, a positive sign indicates a revenue for the TSO while a negative sign indicates costs for the TSO. The principle of all financial flows summing up to zero (section 4.2) is illustrated by the last row of the table.

Table 1 - Detailed but anonymized information on the settlement of unintended exchange in an exemplary quarter hour (August 1st, 2023 from 00:00 to 00:15 CEST)

Situations with high unintended exchanges are quite critical for a TSO. Due to the frequency-dependent component, high volumes may cause high payment flows especially in quarter hours with high frequency deviations. It also turns TSOs attention to long-lasting under-frequency deviations and thus grid time deviations, which are caused by an under-supply of a TSO lasting for several days or weeks. In this case, the principle that unintended exchange has an average value of zero in the long-term does not apply anymore. Accordingly, high deviations and corresponding payment flows accumulate within a short time. Continental European TSOs have taken the high payment flows as an opportunity, especially in October and December of 2021, to critically examine the situation in the originating LFC areas of partners F and G and to urge to an improvement. The general trend of increasing compensation payments (excluding the special cases in October and December of 2021) reflects the increased price level on the markets for scheduled energy.

6. Conclusions

Due to regulatory requirements and harmonization of the compensation mechanism for unintended exchange with other processes of energy exchange, the financial compensation of unintended exchange has been introduced in June 2021 [5]. The applied methodology for recording and pricing the energy volumes – provided FCR, ramping energy as well as unintended exchange – has been described in this article. The specific steps for implementation and financial processing have also been presented.

The implementation of this methodologies could only be achieved in time because all Continental European TSOs cooperated successfully to adapt their operational processes.

Despite the successful implementation, the envisaged target that the price for the unintended exchange should reflect the balancing energy prices will only be achieved at a later stage after the European balancing platforms have gone live and all TSOs accessed accordingly. This will again strengthen the robustness of the financial compensation of the unintended exchange. The first months of operational experience with financial compensation will make an important contribution for the upcoming next steps.

References

- European Commission. (2017, August). Commission Regulation (EU) 2017/1485 of 2 August 2017 establishing a guideline on electricity transmission system operation. [Online].

- J. Ossanna, H. Graner and F. Hofmann. (1931). “Frequenz- und Leistungssteuerung (Netzkennliniensteuerung)”, DRP 634025

- UCPTE, “Die praktische Anwendung der Leistungs-Frequenzregelung in Westeuropa”, UCPTE Jahresbericht 1954 – 1955.

- UCPTE, “Active Power Control in the UCPTE System – Inventory”, UCPTE Annual Report 1990.

- European Commission. (2017, November). Commission Regulation (EU) 2017/2195 of 23 November 2017 establishing a guideline on electricity balancing. [Online].

- European Parliament and Council. (2019, June). Regulation (EU) 2019/943 of 5 June 2019 on the internal market for electricity (recast). [Online].

- K. Kleinekorte and F. Reyer: “Grundsätzliche Aspekte der Abrechnung des Energieaustausches im Verbundnetz”, Elektrizitätswirtschaft – Zeitschrift der Vereinigung Deutscher Elektrizitätswerke – VDEW, vol. 96, no. 23/1997, pp. 1322-1329, 1997

- ENTSO-E. (2023). Frequency Containment Reserves (FCR). [Online].

- Consentec GmbH on behalf of German TSOs. (2022, August). Description of the balancing process and balancing markets in Germany. [Online]

- ENTSO-E. (2023). Imbalance Netting. [Online].

- ENTSO-E. (2022, December). Synchronous Area Framework Agreement. [Online]

- UCPE. (2004, July). P2 – Policy 2: Scheduling and Accounting [E]. [Online].

- ENTSO-E. (2017, November). All TSOs’ proposal for the determination of LFC blocks for the Synchronous Area Continental Europe in accordance with Article 141(2) of the Commission Regulation (EU) 2017/1485 of 2 August 2017 establishing a guideline on electricity transmission system operation. [Online].

- National regulation authorities. (2020, May). Approval by concerned regulatory authorities of All continental European TSOs’ proposal for common settlement rules for intended exchanges of energy as a result of the frequency containment process and ramping period in accordance with the Article 50(3) of Commission Regulation (EU) 2017/2195 of 23 November 2017 establishing a guideline on electricity balancing. [Online].

- National regulation authorities. (2020, May). Approval by concerned regulatory authorities of All continental European TSOs' proposal for Common settlement rules for all unintended exchanges of energy in accordance with the Article 51(1) of Commission Regulation (EU) 2017/2195 of 23 November 2017 establishing a guideline on electricity balancing. [Online].

Biographies

Prof. Dr. Klaus Kleinekorte received a diploma in electrical engineering and a PhD degree from RWTH Aachen University. Since 1992 he worked with RWE in various management functions. In 2003 he was appointed to the Board of today’s Amprion GmbH. As CTO his main area of responsibility comprised Grid Planning and the Control Centre Brauweiler. Within UCTE, Mr. Kleinekorte was strongly involved in the development of the UCTE Operation Handbook and within CIGRE he represented Germany at the Administration Council and the Steering Committee. Today, he serves as part-time lecturer at RWTH Aachen University.

Dr. Ulf Kasper studied Electrical Engineering at RWTH Aachen University. He joined the university’s Institute of Power Systems and Power Economics finishing his PhD in 2012. Afterwards, Mr. Kasper worked as Expert Control Reserve for TransnetBW GmbH facilitating the entry of new technologies in the national balancing markets. In July 2015, he changed to Amprion GmbH, served as member state expert in the comitology process of Guideline Electricity Balancing and represented the company in various Steering Committees implementing the European markets for scheduled energy and balancing. Today, Mr. Kasper is heading the department Control Reserves and Balancing at Amprion GmbH.

Sebastian Olivares Noguera received B.Sc. degrees in Electrical Engineering and Physics from the Universidad de los Andes, Colombia, in 2015, and his M.Sc. degree in Electrical Engineering and Information Technology from RWTH Aachen University, Germany, in 2018. Since 2018, he worked for Amprion GmbH in the department Control Reserves and Balancing, accompanying European projects in the field of balancing and the settlement of unintended exchange. Since 2023, he works in the Backoffice Ancillary Services at Amprion GmbH.

Dr. Frank Reyer received his diploma degree in Electrical Engineering from the University of Dortmund in 1990 and a PhD degree from the Institute for Electrical Energy Systems at the University of Dortmund in 1995.

Mr. Reyer joined the System Operation Brauweiler of Amprion GmbH (former RWE) in 1995. Since the year 2000, he was responsible for several management functions. Further, he is involved in several national and international steering and working groups (e. g. CWE, ENTSO-E, German TSO Cooperation).

Since 2021, he is responsible as Director System Operation at Amprion GmbH.

Dr. Markus Stobrawe studied Electrical Engineering at RWTH Aachen University. He joined the university’s Institute of Power Systems and Power Economics finishing his PhD. Since 2002, he worked with RWE/Amprion as expert of system operation and ancillary services at the Control Centre Brauweiler close to Cologne and within various ENTSO-E working groups. Since 2014, he is heading the department Energy Market and System Balancing at Amprion GmbH in Brauweiler.

- [1] Several LFC areas can be combined as a load frequency control block (LFC block) physically demarcated by points of measurement at interconnectors to other LFC blocks and operated by one or more TSOs fulfilling the obligations of load-frequency control [1].

- [2] Due to the inertia of the overall system of (thermal) power plants and grid load, a further shortening of the schedule period does not make sense. The overall system cannot reach the new operating point in shorter time intervals.